TSMC Announces 2023Q1 Financial Report

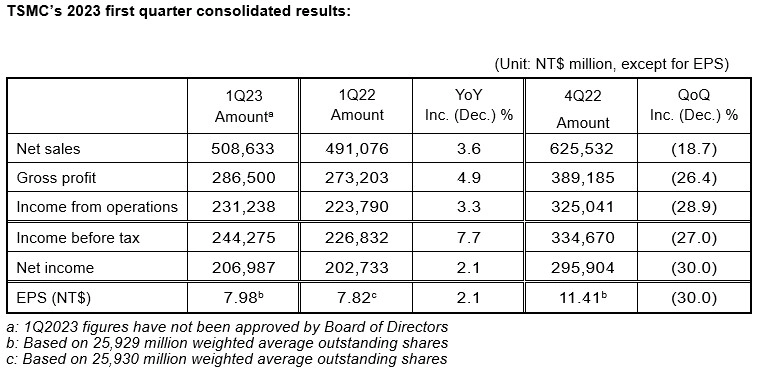

TSMC announced its financial results for the first quarter of 2023 yesterday, revealing revenue of NT$508.63 billion, a year-on-year increase of 3.6%, and a quarter-on-quarter decrease of 18.7%. In US dollars, the revenue was $16.72 billion, representing a year-on-year decline of 4.8% and a quarter-on-quarter decline of 16.1%, barely reaching TSMC’s prior expectations (between $16.7 billion and $17.5 billion).

In Q1 2023, TSMC’s net profit amounted to NT$206.9 billion, a year-on-year increase of 2.1%. Diluted earnings per share were NT$7.98 ($1.31 per ADR unit), a 2.1% increase compared to the same period last year. Compared to Q4 2022, Q1 2023’s net profit decreased by 30%.

TSMC’s gross margin in Q1 2022 was 55.6%, surpassing 55% and considerably higher than 2020’s 53%. In Q2 2022, TSMC’s gross margin rose to 59.1%, exceeding its original estimated range of 56% to 58%. By Q3 2022, TSMC’s gross margin exceeded 60%, reaching 60.4%, with an operating profit margin of 50.6%. In Q4 2022, TSMC’s gross margin continued to climb, achieving 62.2%, and an operating profit margin of 52%. However, in Q1 2023, TSMC’s gross margin and operating profit margin both declined, falling to 56.3% and 45.5%, respectively.

In Q1 2023, shipments of 5nm and 7nm processes both experienced a slight decline, accounting for 31% and 20% of total revenue, respectively. Combined, they amounted to 51% of sales, with advanced processes still constituting more than half of the revenue. Currently, TSMC defines 7nm or more advanced processes as advanced processes.

TSMC stated that its revenue performance in 2023 was impacted by the overall economic downturn and adjustments made by customers due to weakening end-market demand. Entering the second quarter, TSMC’s overall performance is expected to continue being affected by customer inventory adjustments. TSMC anticipates Q2 2023 revenue to be between $15.2 billion and $16 billion (assuming an average exchange rate of 30.4 NTD to 1 USD), with a gross margin between 52% and 54%, and an operating profit margin between 39.5% and 41.5%. TSMC has also lowered its revenue forecast for the full year of 2023, changing it from a slight increase to a decline of 1% to 6%, halting 13 consecutive years of growth.