From 720 to 250: The Drastic Decline of Global Smartphone Brands

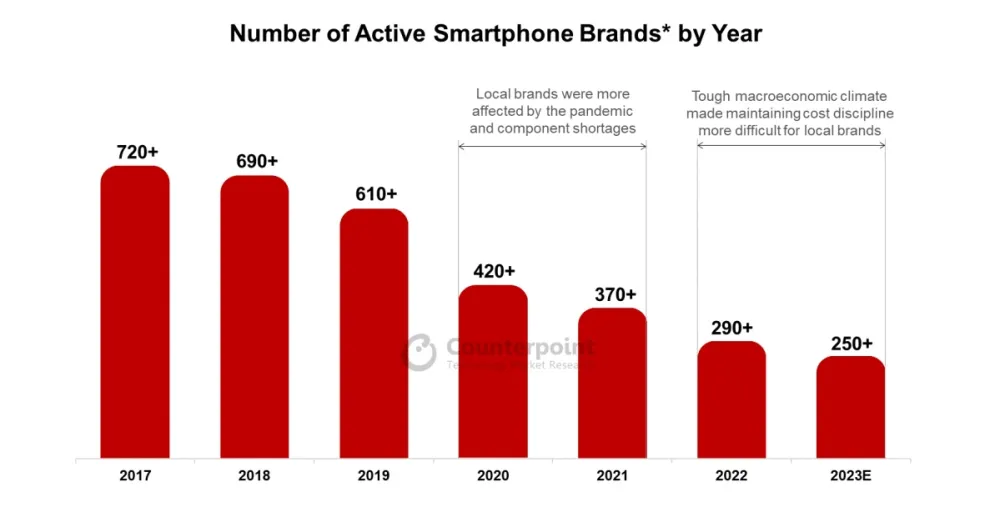

Market research firm Counterpoint revealed that in 2017, over 720 smartphone brands were operating in more than 70 countries worldwide. However, by 2023, this number dwindled to fewer than 250.

Counterpoint’s analysis suggests that this decline primarily stems from the saturation of the smartphone market. Many brands operated as private labels focusing on regional sales or catering to niche consumer segments. Such brands typically did not prioritize smartphone sales. Often, they were local small-scale operators without in-house hardware research and development capabilities. This lack of technical prowess made transitioning from 4G to the 5G network challenging.

Moreover, the meteoric rise of Chinese brands has severely impacted the competitive growth potential of indigenous brands from Europe, North America, Southeast Asia, the Asia-Pacific region, Africa, and Latin America. Examples include India’s Micromax and Bangladesh’s Symphony. Chinese giants like Xiaomi, OPPO, vivo, and realme have aggressively expanded their global market presence over the years, making survival arduous for regional brands.

Not only local brands but also erstwhile leading names in the industry have felt the brunt of this shift. For instance, LG announced its complete withdrawal from the smartphone market last year. Brands like Sony and HTC no longer command the same market prominence as before. Even industry stalwarts like Samsung and Apple have had to reevaluate and recalibrate their market strategies to maintain a competitive edge.

Counterpoint anticipates further contraction of the number of smartphone brands. Even the more established names will need to ramp up technological innovation and modify their market strategies to remain viable.

Nevertheless, industry players, including Qualcomm, remain optimistic about the future of the smartphone market, perceiving ample opportunities for competitive growth.