Analyst Stacy Rasgon lowered the firm’s rating on AMD

The PC market has turned in reverse over the past few months, with shipments continuing to decline in the fourth quarter of last year, with nearly all manufacturers posting double-digit percentage declines. Intel, AMD, and Nvidia have all experienced a sharp drop in revenue in a single quarter. At this stage, the excess inventory of PC machines and components is still serious, and manufacturers will still face challenges in the next few quarters.

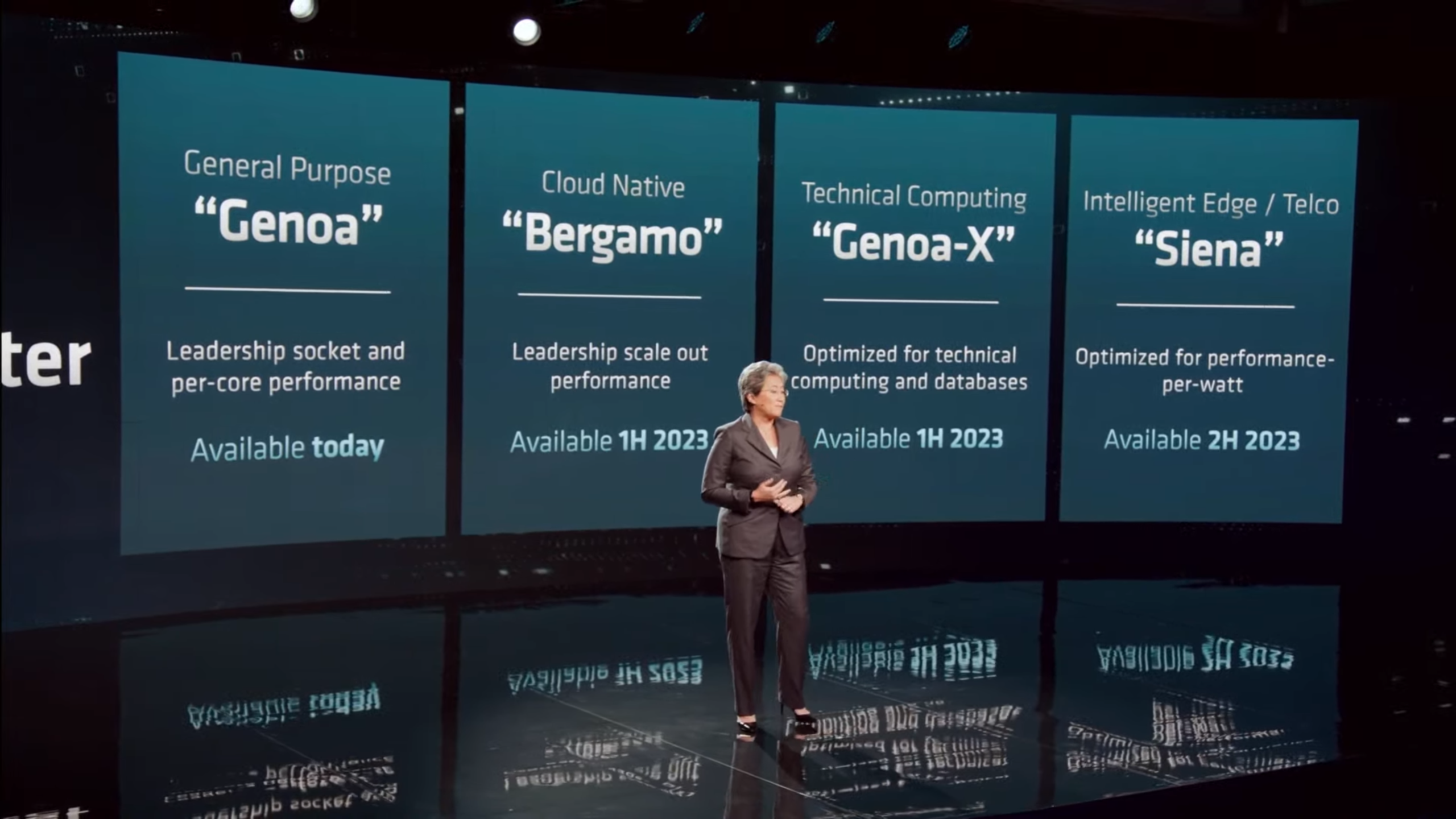

According to Seeking Alpha, some financial institutions have downgraded AMD’s buy rating on the grounds that the PC market will continue to be weak, and the target stock price has also been lowered from $95 to $80 per share and pointed out that the PC market situation has continued to deteriorate over the past year. Despite the weakness in the PC space, analyst Stacy, Rasgon noted that AMD (AMD) has continued to see strength in the data center space, with the firm’s thesis having played out “in spades,” due in part to the company’s Genoa chips, compared to Intel’s (INTC) many issues with its Sapphire Rapids chips. AMD’s new products are heavily discounted within a short period of time after they go on the market, coupled with rising costs, which may affect its gross profit margin.

AMD’s response lies in the data center field. In November last year, it released the Zen 4 architecture EPYC server processor code-named Genoa, which continued to promote the growth of its market share and has higher profits than the consumer side. Coupled with the focus on high-end desktops and laptops on the consumer side, although the growth of market share has been sacrificed to a certain extent, sales and profits can be maintained.