The US court: Qualcomm must agree to be monitored for seven years due to Qualcomm’s abuse of market dominance

Earlier, Qualcomm and Apple announced a settlement and ended the patent war that lasted for many years. Behind the settlement, Apple compensated Qualcomm and continued to purchase Qualcomm chips. For Qualcomm, this patent battle with Apple not only won but also brought great benefits, but Qualcomm has to face more than just Apple. Two years ago, the US International Trade Commission announced that it had prosecuted Qualcomm. The reason given was that Qualcomm abused market dominance and consolidated its monopoly position.

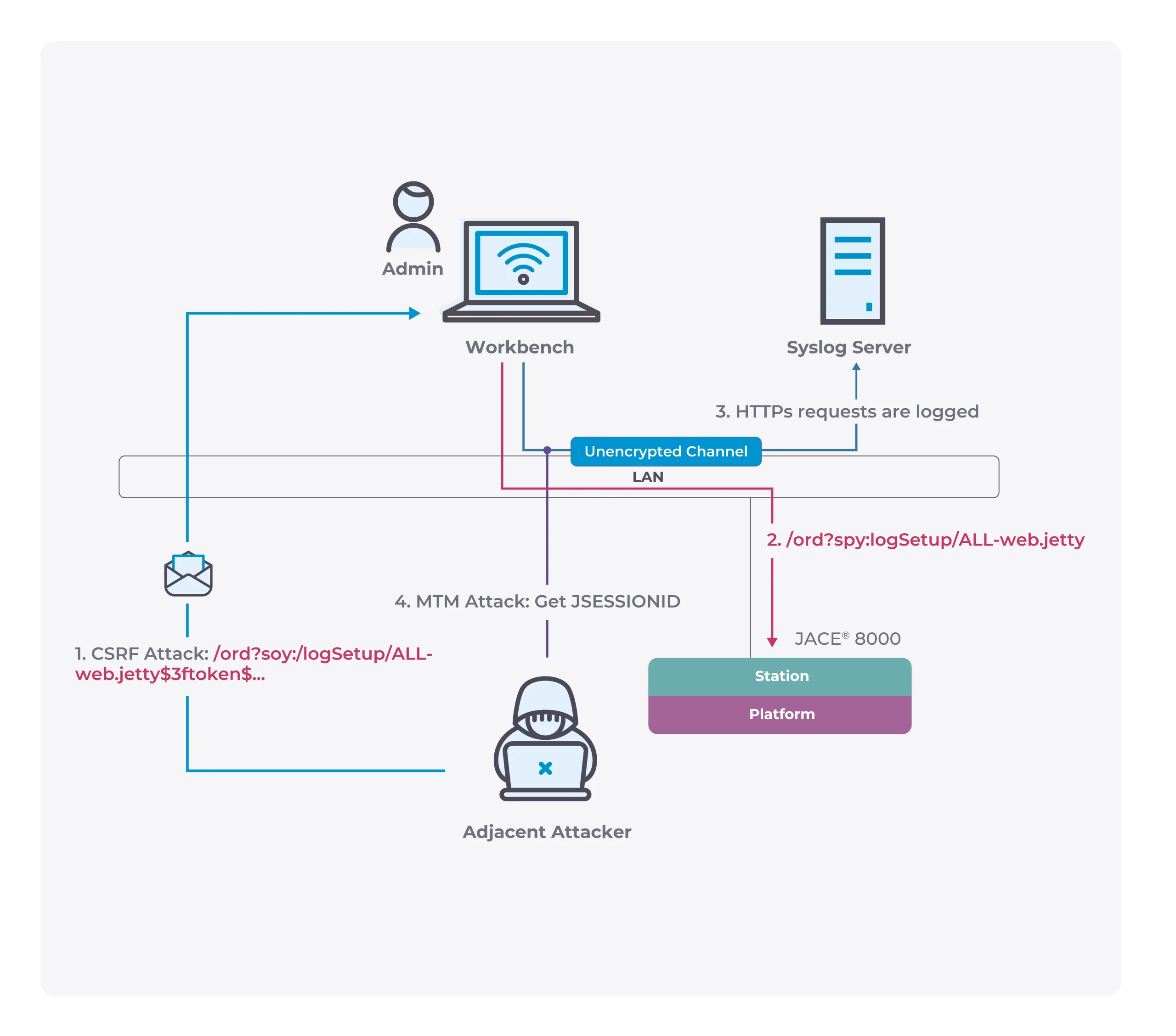

Qualcomm’s “no license, no chips” policy: If you want to buy Qualcomm processors and baseband chips, you must sign a patent license with Qualcomm or not sell chips. Refusal to authorize the necessary patents to the opponent: Although Qualcomm is committed to complying with the fair and reasonable and non-discriminatory provisions to authorize the necessary patents, in reality, this is just a slogan. Subsidized Apple became an exclusive supplier: Qualcomm previously signed an agreement with Apple to subsidize Apple, and then let Apple only use Qualcomm’s baseband chips.

A few days ago, the US courts have made a judgment in favor of the International Trade Commission, which is that Qualcomm has violated the rules of market abuse and monopoly. These violations will stifle the key competition in the modern chip market, so the court asked Qualcomm to re-negotiate with partners and commercial customers. Negotiations require Qualcomm to award its necessary patents to competitors at a fair and reasonable price and must have an exclusive agreement with Apple’s customer service. In addition, the court also required Qualcomm to be supervised for the next seven years and will continue to be processed if it is found that it has not been implemented as required.

However, Qualcomm is facing more problems than this judgment, and subsequent investigations may continue to expand to Qualcomm’s patent and commercial licensing model. Therefore, after the US federal court’s judgment news was released, Qualcomm’s share price immediately fell by 10%. It can be seen that the capital market also understands the risks that Qualcomm now has.

Via: theverge