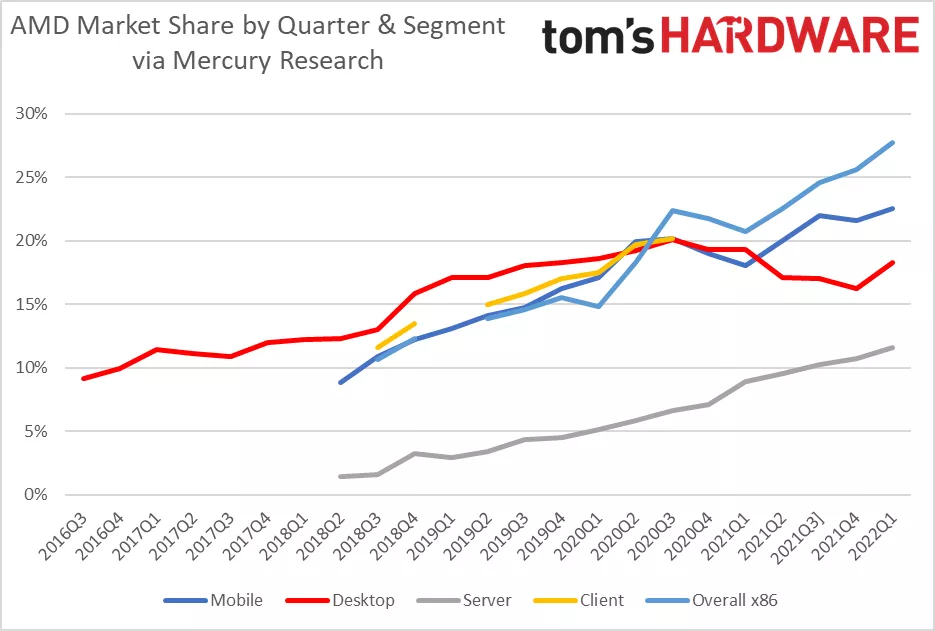

A previous report from research and analysis firm Mercury Research showed that in the fourth quarter of 2021, AMD’s overall market share in x86 processors unsurprisingly hit an all-time high of 25.6%. Among them, AMD’s market share in server processors has grown for 11 consecutive months, reaching 10.7%.

According to

TomsHardware, the latest report from Mercury Research shows that in the first quarter of 2022, almost all x86 processor segments saw a decline in shipments, with the exception of IoT/SoC. Among them, the desktop market lost the most, falling 30%, which is the largest single-quarter decline in history. However, in this turbulent market environment,

AMD still achieved good results, the overall market share of x86 processors hit a record high of 27.7%, an increase of 7% compared to the same period last year. In addition, Apple continues to lead Arm chips to move forward, narrowing the distance with x86 processors in terms of shipments. In fact, the Mac business has also declined, but the magnitude is relatively small.

Although shipments declined, the average processor price in the desktop and mobile markets reached $138, up 10% month-on-month and more than 30% year-over-year. The reason is the decline in shipments of entry-level processors and the start of shipments of new mobile processors from Intel and AMD, which drove up average prices.

Both Intel and AMD suffered due to the sharper drop in sales in the desktop market, although AMD fared better. It is understood that the decline in desktop market sales has a lot to do with suppliers’ destocking, and of course, there are other factors, such as global economic turmoil, inflation, seasonal adjustments, etc., these factors combine to reduce market demand.

The mobile market is somewhat similar to the desktop market, leading to sales declines for both Intel and AMD. However, AMD continued to make progress in the mobile market, and its share also set a new record, reaching 22.5%, an increase of 4.4% compared to the same period last year. AMD mainly benefited from sales of business laptops, which supported its shipments.