AMD short interest has risen to 71.6 million shares

As the performance of the past year has soared, AMD’s stock price has also been on the fast track. On July 29, the US stock market, AMD’s stock price historically broke through the $100 mark. Before the release of the first-generation Zen architecture processor, AMD’s stock price was only about $7, which means it has risen by more than 13 times. AMD can be said to be one of the best-performing stocks in the US stock market in the past few years.

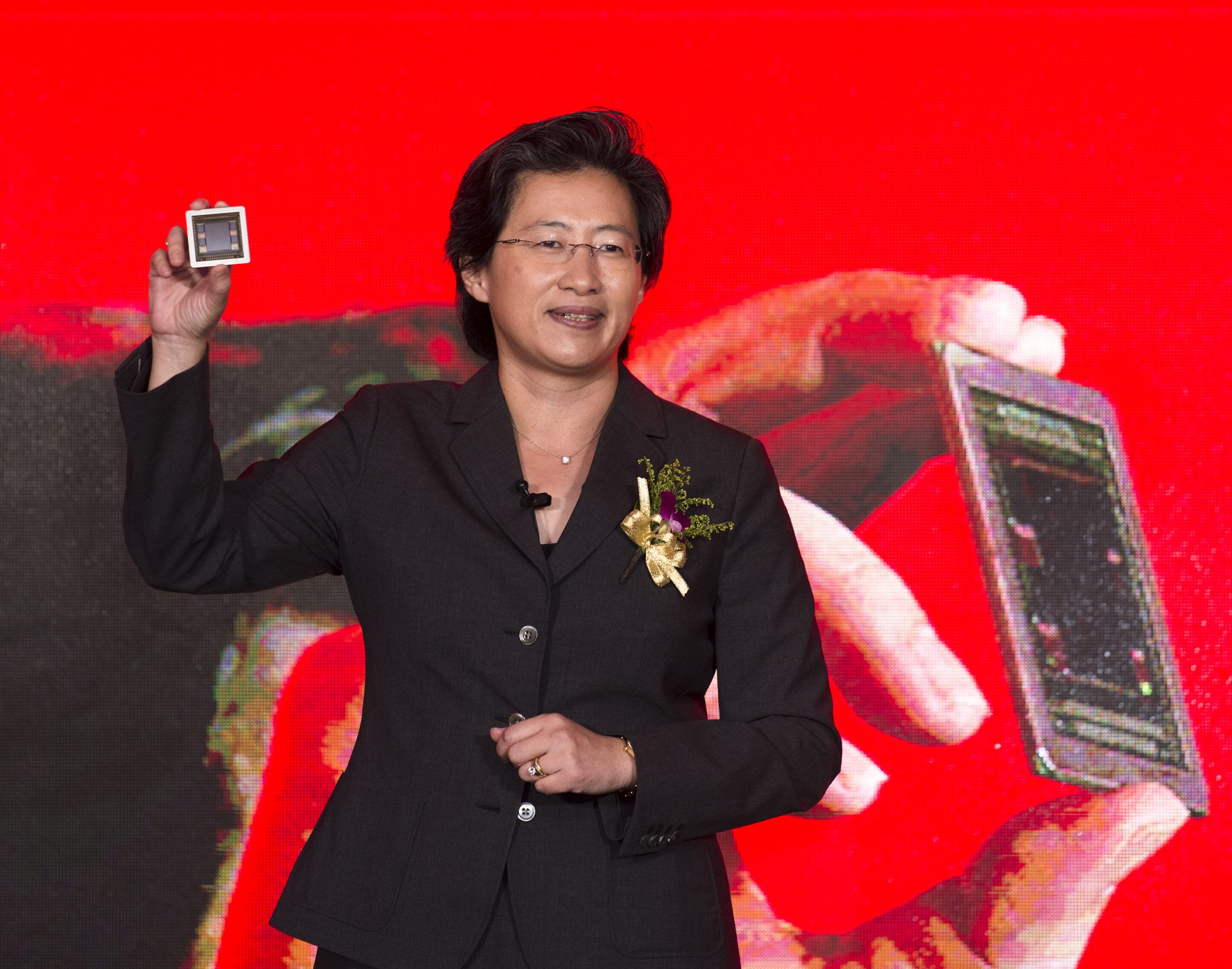

“File:AMD CEO Lisa Su 20150603.jpg” by Gene Wang is licensed under CC BY 2.0

Of course, this is not the end of AMD’s stock price. With the further growth of revenue and the increase in market share, investment institutions have also raised AMD’s target stock price to more than $160. At the end of last month, AMD’s stock price finally broke through $160. Over the past period of time, AMD’s short interest has shown an upward trend, reaching 71.6 million shares at the end of November. Although it is lower than the peak of this year (89 million shares at the end of July), it is a lot more than the 62 million shares at the end of October. At the same time, AMD’s stock price has recently fallen after passing the $160 US barrier, and it is currently staying near $130. This short-term bearishness may be related to AMD’s acquisition of Xilinx. It is rumored that this merger will soon be approved by all major regulatory authorities and the transaction is expected to be completed within this month.

According to Wccftech reports, AMD executives have recently been busy selling their stocks. CEO Dr. Lisa Su sold 125,000 shares for $145 per share in mid-November, making a profit of more than $18 million, at the beginning of December, 125,000 shares were sold again, with a transaction value of approximately $17.7 million. Several other AMD executives, including Chief Financial Officer Devinder Kumar, sold approximately 232,000 shares for between $148 andS$163 during this period.