Western Digital and Kioxia are negotiating a merger

It was reported this spring that Micron and Western Digital are both studying the possibility of gaining control of Kioxia. Kioxia originally planned for an initial public offering (IPO) last fall. At that time, its management expected Kioxia’s valuation to reach $16 billion. Later, due to the spread of the coronavirus epidemic, market uncertainty, and global trade disputes, it was finally delayed indefinitely.

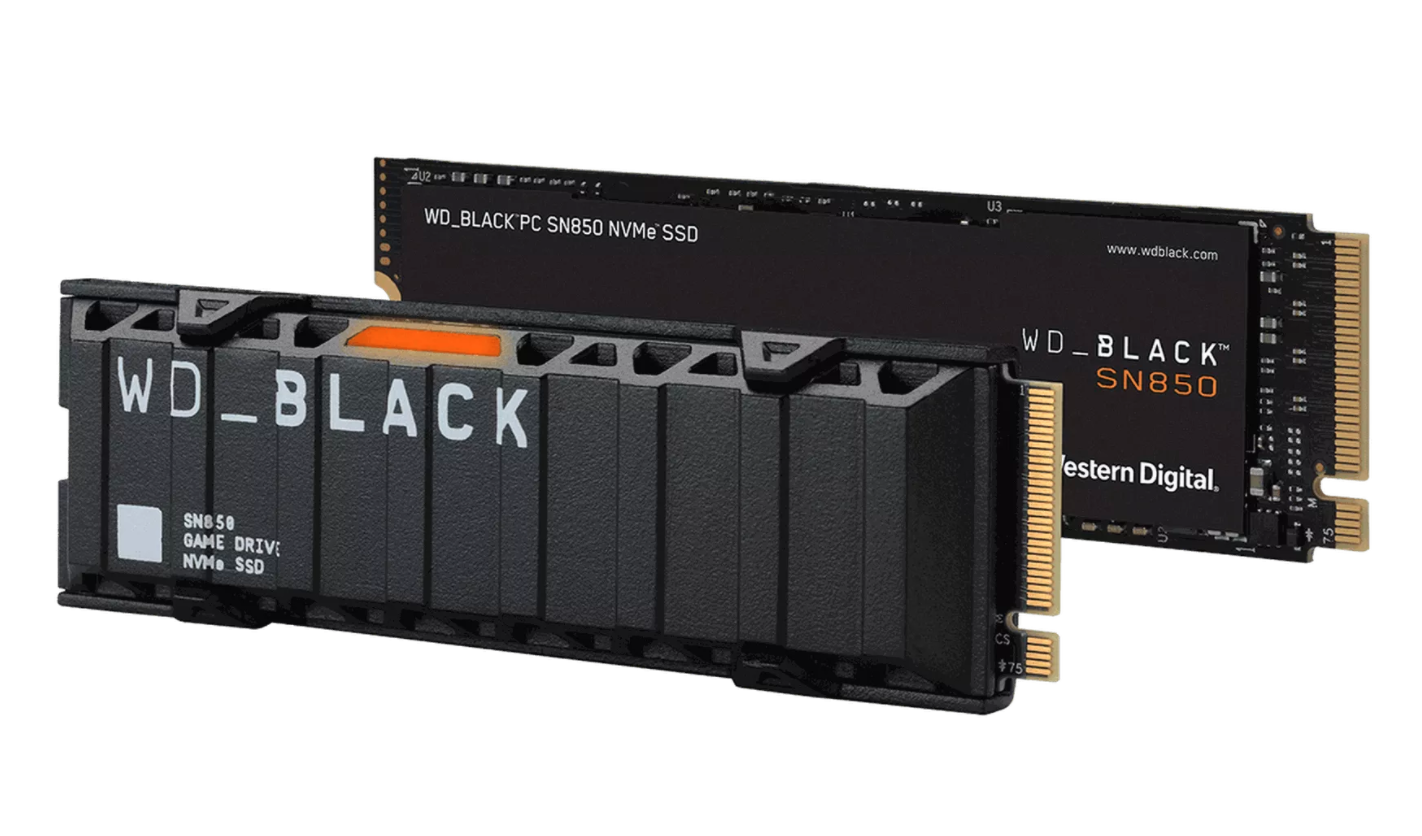

Image: Western Digital

According to the Wall Street Journal report, in the past few weeks, Western Digital and Kioxia have gone through multiple rounds of negotiations to discuss the merger. It is possible to reach a final agreement in mid-September. The transaction amount is expected to reach $20 billion. If the two parties can finally come together, they will become a giant in the data storage industry. In essence, this is a merger of three different brands: Kioxia, Western Digital, and SanDisk. There is no doubt that the new company will have a large number of customers, numerous intellectual property rights and patents, leading 3D NAND flash memory production capacity and hard disk manufacturing capacity, multiple development teams, etc.

In fact, the relationship between Western Digital and Kioxia is very close. The two sides jointly own two wafer fabs in Japan, and they produce more NAND flash memory than any manufacturer in the industry. According to statistics, in the first quarter of 2021, the combined market share of Western Digital and Kioxia was 33.4%, only 0.1% less than Samsung. Even if SK Hynix acquired completely Intel’s 3D NAND and storage business, it still lags far behind the combined share of Western Digital and Kioxia, while Micron’s gap is even greater.

Such a company that controls more than one-third of the supply of NAND flash memory and HDD will affect the competitive landscape of the entire market and will inevitably be subject to scrutiny by antitrust regulators. Regulators from the United States, the United Kingdom, Japan, China, and the European Union will certainly scrutinize this transaction carefully, and it will be more stringent than SK Hynix’s acquisition of Intel’s 3D NAND and storage business.