Intel released the financial report for Second-Quarter 2021: Revenue exceeded expectations

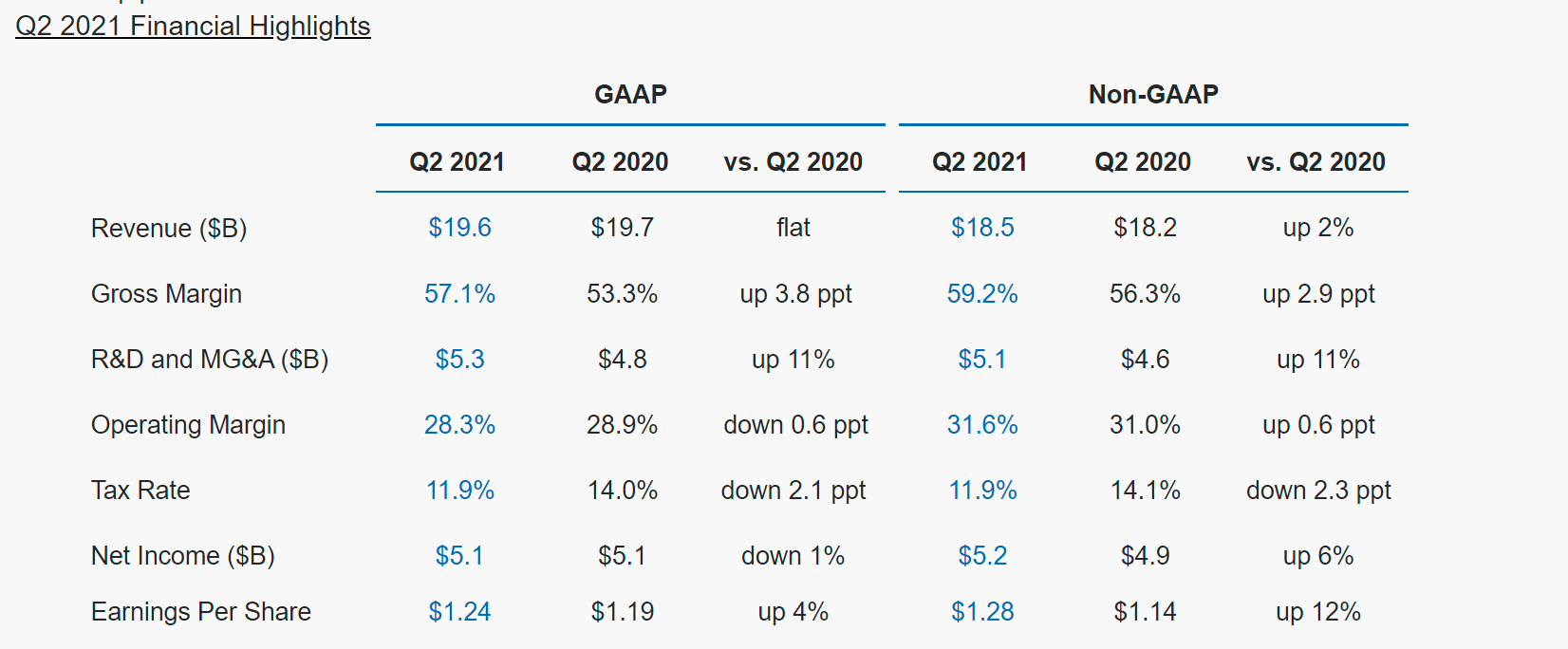

Intel released its second-quarter 2021 financial report yesterday. For ten consecutive quarters, revenue exceeded expectations. Its sales of personal computers, including desktops and notebooks, increased by 33% year on year. However, the performance of the server market is still weak, and the increasing supply chain costs are eroding its profits, causing Intel to lower its gross margin expectations.

Although there was 15% and 40% sales growth in desktops and laptops, the revenue was at the expense of price reductions. The average selling prices of the two dropped by 5% and 17%, respectively. This shows that Intel is taking lower measures to grab market share with AMD. In addition to personal computers, the highlight in the financial report is still the autonomous driving system company Mobileye, with quarterly revenue of $327 million, a substantial increase of 128% year-on-year. Intel hopes that Mobileye can become a mainstream brand of autonomous driving systems. It has already begun road testing in New York City and is the only company in New York that holds an autonomous vehicle test license. The data center department performed poorly, with revenue of $6.5 billion, a year-on-year decrease of 9%. Intel said it would face a more intense competitive environment.