Goldman Sachs may consider ending cooperation with Apple

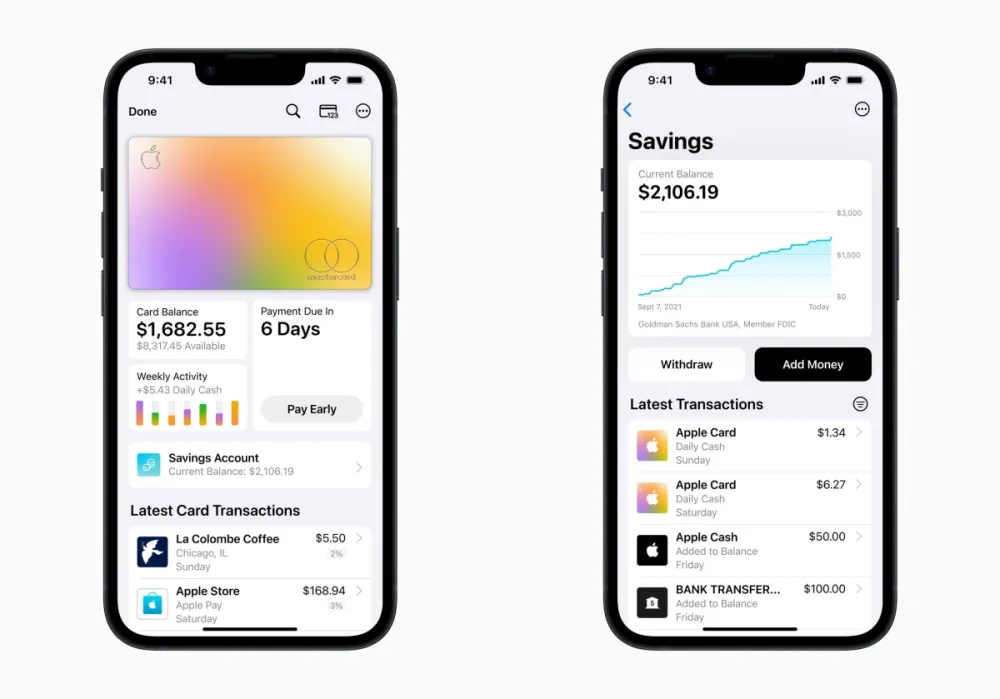

The Wall Street Journal suggests that Goldman Sachs harbors reservations about the continued viability of the Apple Card savings account service, launched in collaboration with Apple offering high interest rates. Consequently, there is speculation that the bank may decide to terminate this partnership, potentially impacting the current Apple Card and its affiliated savings account services.

Apart from deliberating the cessation of its collaboration with Apple, the report intimates that senior executives at Goldman Sachs are contemplating terminating their credit card venture, ‘My GM Rewards,’ co-launched with General Motors. Furthermore, the bank might even consider retreating from the consumer loan product landscape.

However, it appears that a definitive resolution has not yet been reached within Goldman Sachs, though clarity might be imminent with the upcoming quarterly financial report.

The report further attributes Goldman Sachs’ contemplation of ending its partnership with Apple to the substantial losses incurred, amounting to billions of dollars, due to the ‘Apple Pay Later’ buy-now-pay-later service and other credit offerings. The cost calculation methods associated with the Apple Card credit services have apparently exerted significant pressure within the bank. Evidently, Goldman Sachs has found it challenging to persuade Apple to adapt the Apple Card to conventional credit card late fee calculations.

If Goldman Sachs cannot mitigate the losses stemming from its consumer market products, it might opt to divest its collaborative ventures with Apple and General Motors. If they resort to relinquishing the Apple partnership, encompassing the savings account services, to another bank, Goldman Sachs might also need to resort to emergency funds to bridge the loss.

Previously, The Wall Street Journal also posited that the Apple Card credit service might transition into a collaboration with American Express. However, it seems that even American Express currently has apprehensions regarding the evolution of Apple’s credit card venture.